A sustainability bond is a type of financial instrument used to raise capital for projects that deliver both environmental and social benefits.

Although similar in structure to a government bond, a sustainability bond differs in its purpose. The proceeds are specifically directed toward projects that protect the environment and support long-term social resilience.

The first tranche of the Zanaco Sustainability Bond — valued at USD 50 million — will be issued via private placement and is available to institutional investors only.

As the first tranche of the Zanaco Sustainability Bond will be available to institutional investors only. Zanaco will advise how you can invest in the bond when the instrument is ready to go to the market.

The Zanaco Sustainability Bond will be USD100 million to be issued in two tranches. The first tranche will be a USD50 million sustainability bond and the second tranche will be USD50 million. The use of proceeds for the second tranche will be advised at issuance stage.

The funds raised on the Zanaco Sustainability Bond will be used to fund projects that benefit the environment and future proof the society.

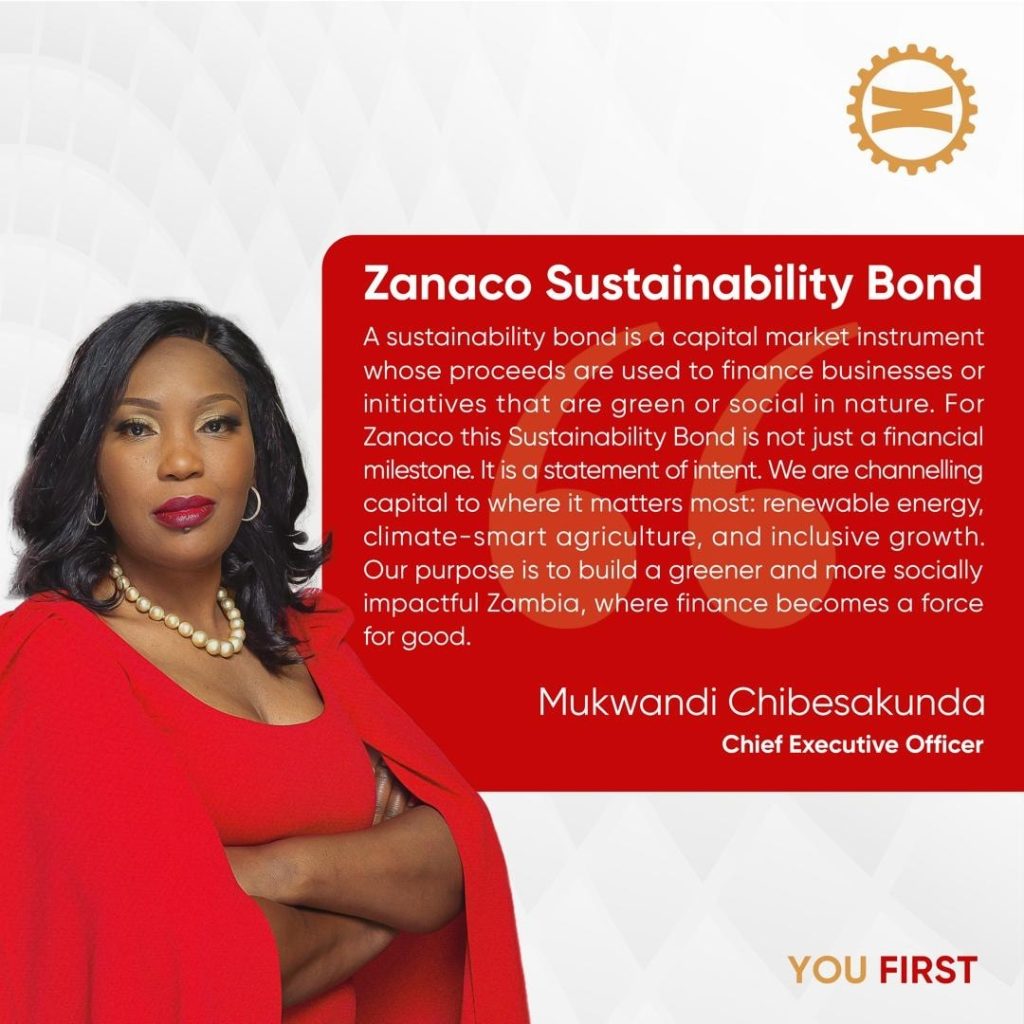

Through this sustainability bond, Zanaco is expanding access to capital for Zambia’s sustainable development agenda. We are creating a pathway for investors to participate directly in financing projects that safeguard our environment while stimulating growth and resilience.

Zambia faces significant challenges driven by climate vulnerability. Our economy relies heavily on agriculture, which was hit last year by the driest growing season in over forty years. Drought affected 84 districts, with maize production falling by over 50%, exacerbating food insecurity and sending ripple effects through rural livelihoods. More than 75% of smallholder farmers remain vulnerable to climate shocks, and rural poverty stands at approximately 76% according to the United Nations Office for the Coordination of Humanitarian Affairs. The Zanaco Sustainability Bond aims to tackle such climate related challenges and better the environment.

The Zanaco Sustainability Bond aligns with the Sustainability Bond Guidelines 2021, Green Bond Principles 2021, and Social Bond Principles 2023, as administered by ICMA. The Sustainability Bond also aligns with the Bank of Zambia Green loan guidelines and the Securities and Exchange Commission Green Bond Guidelines.